Compostable Paper Barrier Coating Market Trends 2026-35

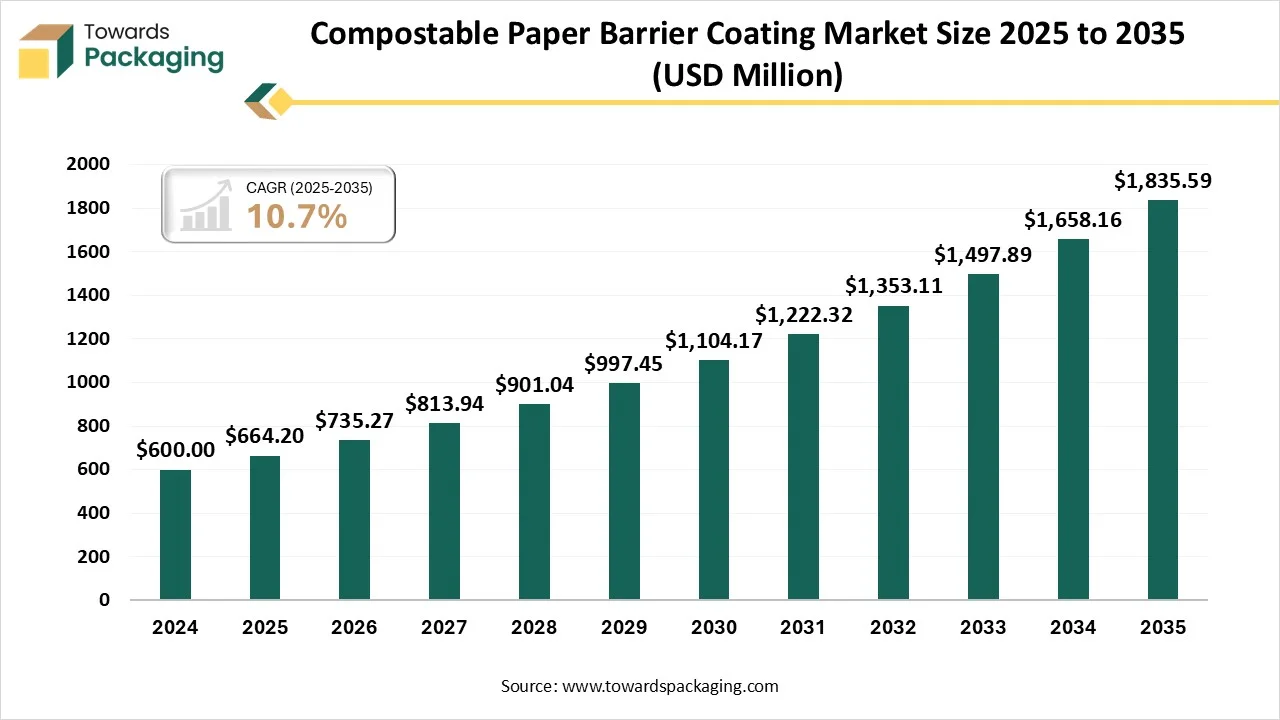

Based on insights from Towards Packaging, the global compostable paper barrier coating market will likely grow from USD 664.20 million in 2025 to around USD 1835.59 million by 2035, expanding at a CAGR of 10.7% over the 2026–2035 period.

Ottawa, Feb. 04, 2026 (GLOBE NEWSWIRE) -- The global compostable paper barrier coating market reached approximately USD 664.20 million in 2025, with projections suggesting it will climb to USD 1835.59 million in 2035, according to a report from Towards Packaging, a sister firm of Precedence Research.

Request Research Report Built Around Your Goals: sales@towardspackaging.com

What is Meant by the Compostable Paper Barrier Coating?

A compostable paper barrier coating is a sustainable, specialized layer (often plant-based or bio-polymer) applied to paper to provide water, grease, and oxygen resistance while remaining fully biodegradable. Unlike traditional plastic coatings that render paper hard to recycle, this eco-friendly coating is designed to be compostable and often repulpable, offering a sustainable alternative for food and product packaging.

Get All the Details in Our Solutions - Access Report Sample: https://www.towardspackaging.com/download-sample/5942

Private Industry Investments for Compostable Paper Barrier Coating

- Tetra Pak has invested €60 million in a new pilot plant to develop a paper-based barrier technology that replaces traditional aluminum foil, increasing renewable content in their cartons.

- Solenis expanded its sustainable solutions portfolio by acquiring Topchim, a Belgium-based chemical company specializing in eco-friendly coating technology for paper and board production.

- Eastman partnered with UPM Specialty Papers to develop a novel food packaging solution that uses Eastman's bio-based, compostable Solus performance additives and UPM's compatible base papers.

- PakItGreen is a startup developing water-based paper barrier coatings that block moisture, oil, and oxygen to replace single-use plastics and integrate seamlessly into existing production lines.

-

Terram Lab creates proprietary plastic-free, water-based coating technologies that deliver barrier protection for food packaging without using petroleum-derived polymers or PFAS, ensuring the packaging remains compostable and recyclable.

What Are the Latest Key Trends in the Compostable Paper Barrier Coating Market?

- Water-Based and Bio-Based Formulations: A shift toward water-based, plant-based, and seaweed-derived coatings is dominating, replacing PE and PFAS for grease/water resistance in food packaging.

- Mineralized Coatings (EarthCoating): The use of specialized mineral blends with biopolymers improves barrier performance while reducing total plastic content by up to 51%, enhancing compostability and recyclability.

-

Focus on Home Compostability: The trend is moving beyond industrial compostability to home compostable, heat-sealable coatings to meet consumer demand for easier disposal.

What is the Potential Growth Rate of the Compostable Paper Barrier Coating Market?

The market for compostable paper barrier coatings is primarily driven by the urgent need to replace single-use, petroleum-based plastic coatings in food packaging with sustainable, circular economy-aligned alternatives. Driven by stricter environmental regulations and consumer demand, these coatings often use water-based dispersions or bio-based polymers that provide essential grease, oil, and moisture resistance while ensuring the packaging remains repulpable and compostable.

Regional Analysis:

Who is the leader in the Compostable Paper Barrier Coating Market?

Europe dominated the market in 2025, driven by strict environmental policies, circular economy initiatives, and bans on certain plastic-based food packaging materials. Demand for compostable coatings is strong in food wraps, cups, trays, and bakery packaging. EU directives promoting recyclability and compostability push manufacturers to adopt fiber-based packaging with bio-based barriers. Innovation in dispersion coatings and biodegradable polymer technologies continues to shape regional growth.

Germany Compostable Paper Barrier Coating Market Growth Trends

Germany dominates the European market due to its advanced recycling systems, strong sustainability culture, and large food processing industry. Packaging producers increasingly adopt compostable barrier coatings to comply with EU packaging waste regulations. German manufacturers also lead in technology development, focusing on high-performance coatings that provide grease, moisture, and oxygen resistance while maintaining compostability and recyclability standards.

How is Asia Pacific Expected to Witness Growth in the Compostable Paper Barrier Coating Industry?

Asia Pacific is expected to experience the fastest growth in the market in the forecast period, as governments and industries respond to rising plastic pollution concerns. The rapid expansion of the food delivery, retail, and FMCG sectors drives demand for sustainable paper packaging alternatives. Growing regulatory attention on plastic reduction and increasing investment in green packaging manufacturing capabilities support the adoption of compostable barrier coatings across China, India, Japan, and Southeast Asia.

China Compostable Paper Barrier Coating Market Trends

China leads regional growth due to strong government measures aimed at reducing plastic packaging waste and promoting biodegradable materials. The country’s massive food service and e-commerce sectors create substantial demand for coated paper packaging. Domestic manufacturers are investing in water-based and bio-polymer coating technologies to replace polyethylene and fluorochemical-based barriers, supporting the expansion of compostable paper packaging solutions.

More Insights of Towards Packaging:

- Temperature Controlled Packaging Solutions Market Size, Trends and Segments (2026–2035)

- Biodegradable Cutlery Market Size, Trends and Competitive Landscape (2026–2035)

- Specialty Films Market Size, Trends and Competitive Landscape (2026–2035)

- Corrugated Bubble Wrap Market Size, Trends and Regional Analysis (2026–2035)

- Pharmaceutical Packaging Machines Market Size and Segments Outlook (2026–2035)

- Smart Containers Market Size, Trends and Regional Analysis (2026–2035)

- Die-Cut Boxes Market Size, Trends and Regional Analysis (2026–2035)

- Expanded Polystyrene for Packaging Market Size, Trends and Segments (2026–2035)

- Lubricant Containers Market Size, Trends and Competitive Landscape (2026–2035)

- Beverage Packaging Machine Market Size, Trends and Competitive Landscape (2026–2035)

- Glass Container Market Size and Segments Outlook (2026–2035)

- Plastic Bottles and Containers Market Size, Trends and Regional Analysis (2026–2035)

- Plastic-Free Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Vial Cap Sealing Machine Market Size and Segments Outlook (2026–2035)

- Food Packaging Films Market Size and Segments Outlook (2026–2035)

- Medical Tubing and Catheters Market Size and Segments Outlook (2026–2035)

- Disposable Food Containers Market Size, Trends and Regional Analysis (2026–2035)

- Polyethylene Mailers Market Size and Segments Outlook (2026–2035)

- Packaging Tapes Market Size, Trends and Competitive Landscape (2026–2035)

- Polyethylene Packaging Market Size, Trends and Regional Analysis (2026–2035)

Segment Outlook

Coating Type Insight

Why Water-Based Barrier Coatings Segment Dominates the Compostable Paper Barrier Coating Market?

The water-based barrier coatings segment dominated the market in 2025, as they are gaining strong traction as a sustainable alternative to conventional polyethylene and wax coatings used in paper packaging. They are widely used in food-contact applications where regulatory compliance and environmental safety are critical. Growth in this segment is driven by plastic reduction mandates, increasing demand for eco-friendly packaging, and brand commitments toward circular economy principles.

The bio-polymer coatings segment is projected to grow at the fastest rate in the market, as they help enhance moisture and grease resistance compared to traditional paper treatments while aligning with sustainability and compostability certifications. Demand is rising in premium food packaging and single-use service ware as manufacturers seek high-performance yet environmentally responsible solutions that meet both functional and regulatory packaging requirements.

Substrate Type Insight

Which Substrate Type Segment Dominates the Compostable Paper Barrier Coating Market?

The paperboard segment dominated the market in 2025, due to its structural strength, printability, and suitability for rigid and semi-rigid food packaging formats. Compostable barrier coatings enhance paperboard’s resistance to moisture and oils, enabling its use in applications traditionally dominated by plastic laminates. The rise in sustainable cartons, trays, and folding boxes for food and beverage packaging continues to drive this segment, supported by retail and food service industries transitioning toward fiber-based packaging alternatives.

The molded fiber segment is projected to grow at the fastest rate in the market, as it is increasingly used for compostable packaging formats such as trays, clamshells, and protective food containers. Barrier coatings improve their performance by reducing liquid absorption and grease penetration while preserving biodegradability. The segment benefits from growing restrictions on expanded polystyrene food containers and rising adoption of molded fiber solutions in takeaway food and quick-service restaurant packaging, where sustainability and performance must be balanced.

Application Insight

How did the Food Packaging Segment Dominate the Compostable Paper Barrier Coating Market?

The food packaging segment dominated the market, accounting for 00% of the market in 2025, driven by the urgent need to replace plastic-lined paper products with compostable alternatives. Barrier-coated paper is widely used for dry, greasy, and moist food items, including bakery products, snacks, and frozen foods. Regulatory pressure, consumer preference for eco-friendly packaging, and retailer sustainability initiatives continue to accelerate adoption, making this segment a primary growth driver for compostable coating technologies.

The take-away & food service packaging segment is projected to grow at the rate in the market, due to rapidly expanding applications as restaurants, cafes, and food delivery platforms shift toward sustainable packaging solutions. Compostable coated paper products, such as cups, bowls, wraps, and containers, help meet regulatory bans on single-use plastics. Rising urbanization, growth of food delivery services, and corporate sustainability commitments from food chains further strengthen demand in this segment.

Elevate your packaging strategy with Towards Packaging. Enhance efficiency and achieve superior results - schedule a call today: https://www.towardspackaging.com/schedule-meeting

Recent Breakthroughs in the Compostable Paper Barrier Coating Industry

In September 2025, Heidelberg and Solenis jointly developed an inline barrier coating application process for paper packaging, presented. This process integrates Solenis' specialty barrier coatings into Heidelberg's Boardmaster flexographic printing press to create recyclable and compostable alternatives to plastic lamination.

In March 2025, Ahlstrom launched LamiBak™ Flex, a high-performance base paper designed for flexible food packaging, aiming to replace traditional plastic and metallic substrates. The paper is made from 100% certified wood pulp, is certified recyclable in the US and Europe, meets industrial compostability criteria in various regions, and is PFAS-free with a natural grease barrier.

Top Companies in the Compostable Paper Barrier Coating Market & Their Offerings

- Stora Enso: Offers the Bio™ series, which consists of bio-based coatings certified for industrial composting that provide moisture, oxygen, and grease barriers for food service items.

- UPM-Kymmene Corporation: Provides UPM Prego™ and UPM Asendo™, compostable and recyclable barrier papers that utilize advanced water-based coatings for food-to-go and dry food applications.

- Sappi Limited: Features the Valida and Guard portfolios, utilizing fibrillated cellulose and dispersion technology to create mono-material paper solutions with integrated barriers that are typically recyclable and biodegradable.

- Michelman, Inc.: Offers BPI-certified compostable coatings such as Michem® Coat 2000, which provide oil and grease resistance for fiber-based food service packaging.

- Siegwerk Druckfarben AG & Co. KGaA: Develops the UniNATURE and CIRKIT ranges, offering water-based functional barrier coatings designed to ensure paper packaging is both compostable and repulpable.

- EcoSynthetix Inc.: Provides DuraBind™ and EcoSphere® biopolymers, which are carbohydrate-based binders and coatings that enable plastic-free, compostable barriers for paper and board.

- BASF SE: Offers Joncryl® and Epotal® water-based dispersions that act as functional barriers for paper, supporting certifications for home and industrial compostability.

- Dow Inc.: Produces RHOBARR™ and CANVERA™ water-borne barrier coatings that enable the creation of high-performance, recyclable, and compostable paper-based packaging.

- Archroma: Features the Cartaguard® and Cartacoat® lines, including PFAS-free, bio-based barrier solutions that provide resistance to grease, water, and oil while maintaining compostability.

- Solenis: Supplies the TopScreen™ barrier coating technology, which uses sustainable materials to provide oil, grease, and water resistance for compostable food packaging applications.

-

Kuraray Co., Ltd.: Offers PLANTIC™ and EXCEVAL™, specialized bio-based polymers used in coatings to provide high gas barriers while remaining fully biodegradable and compostable.

Segment Covered in the Report

By Coating Type

- Water-Based Barrier Coatings

- Acrylic water-based coatings

- PVOH (Polyvinyl Alcohol) coatings

- Water-based dispersion coatings

- Hybrid water-based bio-coatings

- Bio-Polymer Coatings

- Protein-based coatings

- Natural resin-based coatings

- Bio-polymer blend coatings

- Wax-Based Compostable Coatings

- Natural wax coatings (beeswax, carnauba wax)

- Plant-based wax coatings

- Paraffin-free wax coatings

- Starch-Based Coatings

- Corn starch coatings

- Potato starch coatings

- Tapioca starch coatings

- Modified starch coatings

- Cellulose-Based Coatings

- Cellulose ether coatings

- Regenerated cellulose coatings

- Nanocellulose coatings

- Chitosan-Based Coatings

- Pure chitosan coatings

- Chitosan blend coatings

- Antimicrobial chitosan coatings

- PLA-Based Coatings

- Pure PLA coatings

- PLA blend coatings

- Heat-sealable PLA coatings

- Other Bio-Based Coating Formulations

- Algae-based coatings

- Lignin-based coatings

- PHA-based coatings

- Emerging bio-resin coatings

By Substrate Type

- Paperboard

- Paper

- Molded fiber

- Corrugated board

- Specialty fiber substrates

By Application

- Food packaging

- Cups & lids

- Plates & bowls

- Wraps & liners

- Take-away & food service packaging

- Beverage packaging

- Pharmaceutical & healthcare packaging

- Personal care packaging

- Consumer goods packaging

- Industrial & specialty packaging

By Region

- North America:

- U.S.

- Canada

- Mexico

- Rest of North America

- South America:

- Brazil

- Argentina

- Rest of South America

- Europe:

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

- Asia Pacific:

- China

- Taiwan

- India

- Japan

- Australia and New Zealand,

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

- MEA:

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA

Invest in Our Premium Strategic Solution: https://www.towardspackaging.com/checkout/5942

Request Research Report Built Around Your Goals: sales@towardspackaging.com

About Us

Towards Packaging is a global consulting and market intelligence firm specializing in strategic research across key packaging segments including sustainable, flexible, smart, biodegradable, and recycled packaging. We empower businesses with actionable insights, trend analysis, and data-driven strategies. Our experienced consultants use advanced research methodologies to help companies of all sizes navigate market shifts, identify growth opportunities, and stay competitive in the global packaging industry.

Stay Connected with Towards Packaging:

- Find us on Social Platforms: LinkedIn | Twitter | Instagram | Threads

- Subscribe to Our Newsletter: Towards Sustainable Packaging

- Visit Towards Packaging for In-depth Market Insights: Towards Packaging

- Read Our Printed Chronicle: Packaging Web Wire

-

Get ahead of the trends – follow us for exclusive insights and industry updates:

Pinterest | Medium | Tumblr | Hashnode | Bloglovin | LinkedIn – Packaging Web Wire | Globbook | Substack | Bluesky | Justdial | Crunchbase | TrustPilot | Bizcommunity - Contact: APAC: +91 9356 9282 04 | Europe: +44 778 256 0738 | North America: +1 8044 4193 44

Our Trusted Data Partners

Precedence Research | Towards Healthcare | Towards Food and Beverages | Towards Chemical and Materials | Healthcare Webwire | Packaging Webwire | Precedence Research Insights

Towards Packaging Releases Its Latest Insight - Check It Out:

- Smart Corrugated Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Generative AI in Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Liquid Packaging Market Size, Segmentation, Competitive Landscape, and Growth Opportunities (2025-2035)

- Sachet Packaging Market Size, Trends, Share, Trends, Segments, and Regional Insights (NA, EU, APAC, LA, MEA)

- Lightweight Aluminum Beverage Cans Market Size, Trends and Regional Analysis (2026–2035)

- Recyclable Polyethylene-based Laminates Market Size and Segments Outlook (2026–2035)

- Agricultural Films Market Size, Trends and Regional Analysis (2026–2035)

- Recycled PET Bottles Market Size, Trends and Competitive Landscape (2026–2035)

- U.S. Sustainable Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Cardboard Sheet Market Size, Trends and Segments (2026–2035)

- Non-cushioned Mailers Market Size, Trends and Competitive Landscape (2026–2035)

- Aerosol Cans Market Size, Trends and Segments (2026–2035)

- North America Flexible Packaging Market Size, Trends and Regional Analysis (2026–2035)

- BOPP Films Market Size, Trends and Competitive Landscape (2026–2035)

- Protective Films Market Size, Trends and Segments (2026–2035)

- Parenteral Packaging Market Size, Trends and Regional Analysis (2026–2035)

- Converted Flexible Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Compostable Tableware Market Size, Trends and Regional Analysis (2026–2035)

- Trigger Spray Bottle Market Size, Trends and Competitive Landscape (2026–2035)

- Plastic Container Market Size, Trends and Regional Analysis (2026–2035)

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.